Recently, Petra Coach presented a webinar, Preparing for an Extraordinary Exit with STS Capital Partners

You can find the full recording below.

If you are a private business owner with annual revenues of $50M-$2B who is interested in a complimentary strategic business evaluation, please email Angie Sheribel at ExpertGuides@stscapital.com.

For more information on STS Capital Partners, visit https://stscapital.com/PETRA.

Top Takeaways

The 3 Pillars of STS

Expert Guides

We’re entrepreneurs helping entrepreneurs – we’ve been in your shoes. We’re here to guide you on the journey to your Extraordinary Exit.

Selling to Strategics

Achieving maximum financial value in your transactions through Selling to Strategics.

Success to Significance

Helping create legacy potential through our Success to Significance program, supporting charitable donations worldwide.

Considering at Exit? Key Considerations:

- What is driving the decision for an exit?

- What does the ideal exit look like?

- What are your required and preferred outcomes?

- Do you have the success team in place – internal and external?

- Are your financials in order?

- Have you recently been approached by buyers?

- Who do you think could be the ideal buyer?

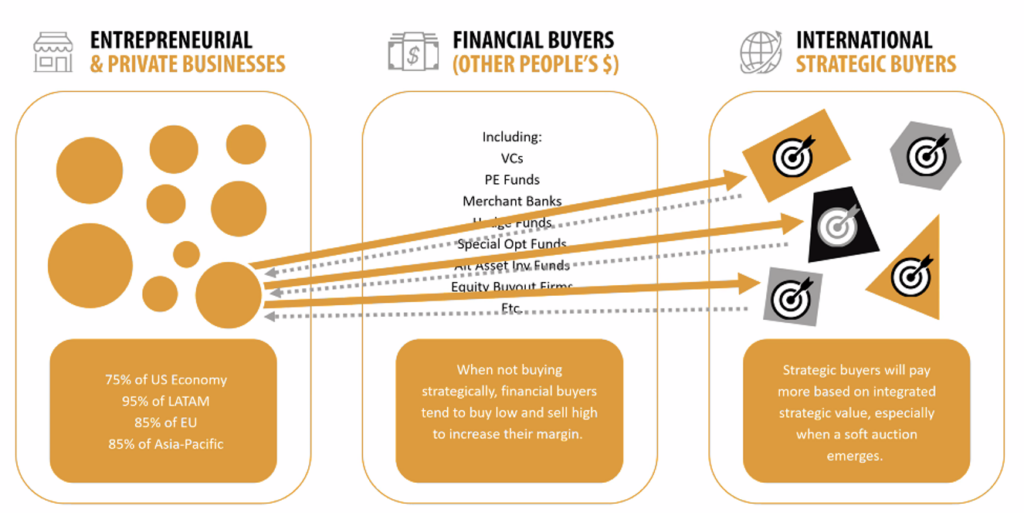

Types of Buyers

Financial Buyers

- Financial investors typically pay as little as possible – with the intent of positioning assets to maximize value on their own pre-planned exit.

- Strategic investors/buyers place more value on the competitive advantages of a business, which can be leveraged across their own business and channels.

Direct Access to Strategic Buyers

We access the highest levels of organizations by leveraging:

- Personal relationships of our Managing Directors and our extensive global network of Advisors, exclusive to STS (who are motivated and aligned through success fee sharing).

- Our proprietary database of over 1,300 acquisition and investment profiles

- Our membership in senior executive level business organizations

Strategic vs. Financial Buyer

- Traditional financial services and i-banks teach us all that M&A is financial and numbers-driven, following industry multiples.

- Financial buyers follow relatively strict models and are efficient. They buy low and sell high, ideally selling to a strategic.

- Good deals…buy-side and sell-side are made for strategic reasons.

- Great deals are underpinned by strategic integration driving value creation for the Buyer…that sometimes is shared with the Seller.

- To sell to a strategic buyer takes a collaborative, creative, and entrepreneurial approach to identify your real value with the strategic, beyond traditional industry multiples and synergies.

- How does a strategic buyer view your business? Think through their lens. What strategic value do you create or transform for them and vice versa?

Maximizing Value by Selling to Strategics

Extraordinary Exit Summary

- What is driving the desire to sell all or a majority of your business?

- What are your required and preferred outcomes?

- What makes you a compelling acquisition for a strategic or financial buyer?

- What are your Rembrandts in the Attic?

- Identify strategic categories/buyers and strategic financial buyers.

- Run a competitive process.

- It’s not about a typical industry multiple (i.e., 6-8x EBITDA, or 1x revenue). It’s about the real integrated strategic value of your business with a strategic buyer.

- Achieve an Extraordinary Exit – both valuation and required/preferred outcomes.

Like what you see? Register for our upcoming workshops & webinars today!